In this all-inclusive guide, we will extensively explore the Enrolled Agent (EA) Exam, also recognized as the Special Enrollment Examination (SEE). Our coverage will include the basics, what’s inside the exam, difficulty, where to register and associated costs. As a trusted resource for tax professionals, we aim to provide you with informative information to help you prepare for and ace the exam.

What is the EA exam?

The EA exam is a three-part exam that covers individual taxation, business taxation, and representation before the IRS. The Enrolled Agent exam is available for candidates to take from May 1st through the end of February in the following year, providing ample time for planning and preparation. Unlike other tax certificates, you don’t need a bachelor's degree to take the exam. The major requirement is the successful completion of the three-part exam. Ideally, candidates should aim to pass all three parts within one year. However, a two-year window is available if needed. Additionally, you don’t need to complete any prerequisites or experience requirements, making it a great option for people who want to specialize in taxation or represent clients before the IRS.

Decoding the EA Exam: An In-Depth Look at the Enrolled Agent Examination Content & Structure

The SEE is composed of three separate parts that test the knowledge of the previous tax year's Internal Revenue Code, Code of Federal Regulations, IRS forms, instructions, and publications. Each part is taken individually and consists of 100 questions, with a 3.5-hour duration allocated. Of the 100 questions, only 85 contribute to the final score, while the remaining 15 serve as experimental items and do not influence the overall score for that particular part.

SEE PART 1 – Individual

Preliminary Work with Taxpayer Data - 14 questions

Income and Assets - 17 questions

Deductions and Credits - 17 questions

Taxation - 15 questions

Advising the Individual Taxpayer - 11 questions

Specialized Returns for Individuals - 12 questions

SEE PART 2 – Business

Business Entities and Considerations - 30 questions

Business Tax Preparation - 37 questions

Specialized Returns and Taxpayers - 18 questions

SEE PART 3 – Representation, Practices And Procedures

Practices and Procedures - 26 questions

Representation before the IRS - 25 questions

Specific Areas of Representation - 20 questions

Filing Process - 14 questions

How hard is the EA exam?

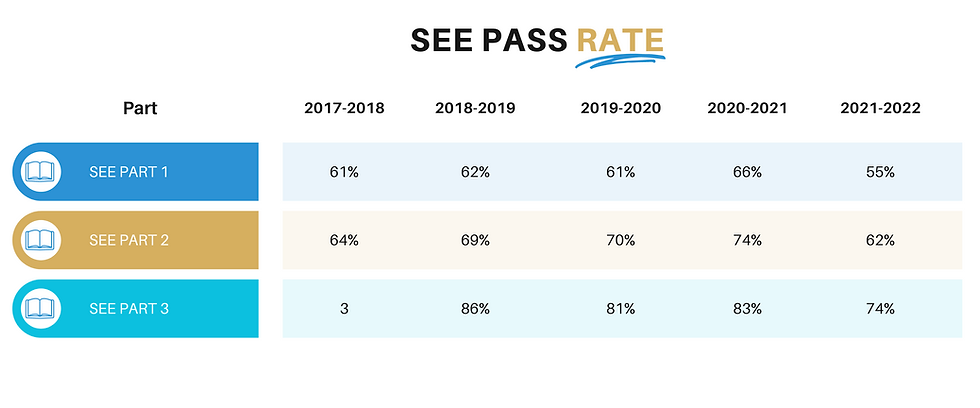

The EA exam is graded on a scale of 40 to 130 points, with the IRS setting the passing score at 105 points. A score of 105 or higher indicates that you possess the necessary knowledge to practice before the IRS. The average Enrolled Agent (EA) exam pass rate currently stands at 74%, remaining within its historical range of 69% to 74%. In comparison to other professional accounting exams, such as the CPA Exam with a pass rate of 45-49%, the EA exam pass rates are significantly higher for all three parts. However, this does not imply that the exam is easy. Instead, it suggests that, with adequate preparation, you can achieve a passing score. The table below presents the pass rate for each part of the exam for the last 5 years.

What kind of questions are on the EA exam?

By testing candidates on real-world tax scenarios and problem-solving skills, the EA exam ensures that successful candidates possess the expertise and competence necessary to represent taxpayers before the Internal Revenue Service (IRS) in a professional capacity.

The questions below presents three common types of multiple-choice questions on the Exam:

Example #1: Incomplete sentences

A child may be subject to kiddie tax in the current year if:

A. Neither parent of the child is alive at the end of the year

B. The child is under age 18 at the end of the tax year

C. The child has only nontaxable income of more than $2,200

D. The child is required to file a tax return and he or she files a joint return for the year Answer: B

References: I.R.C. § 1(g); Form 8615 (2021) Instructions pg. 1

Example #2: Direct questions

The Net Investment Income Tax may apply to which of the following?

A. Alimony

B. Traditional IRA distribution

C. Taxable mutual fund distribution

D. Tax exempt municipal bond interest

Answer: C

References: IRC § 1411(c)(1) and (5); Instructions for Form 8960 Net Investment Income Tax--Individuals, Estates, and Trusts (2021), pages 1, 5 and 6

Example #3: Which of the following is correct/true

Which of the following statements is true regarding rejected electronic filed returns?

A. The ERO must notify the taxpayer within 48 hours if they can’t fix the reason for the rejection

B. The ERO only needs to provide the taxpayer an explanation of the rejection

C. To timely file the return, the taxpayer must file the paper return by the later of the due date of the return or ten calendar days after the notification of rejection D. Taxpayers do not need to include any explanation with the paper return, as to why it is being filed after the due date

Key: C

References: Pub 1345 (2021), page 26

Registration and Fee Breakdown

To register for the exam, candidates must visit the Prometric website, the official testing partner for the IRS, and follow the outlined steps to schedule their examination. As of March 1st, 2023, the fee for each part of the SEE is $206, bringing the total cost for all three parts to $618, payable upon scheduling the examination appointment. It's important to note that these fees are subject to change, and candidates should refer to the IRS website for the most current information. While the exam fees are non-refundable, rescheduling is possible, provided the candidate adheres to Prometric's rescheduling policies. Additionally, candidates should consider the cost of study materials, review courses, and any retake fees if they do not pass a section on their first attempt.

Rescheduling fees are as follows:

30 or more days prior: no fee

5 to 29 days prior: $35.00

Less than 5 days prior: A full examination fee will be charged if you reschedule within five calendar days before your appointment date.

The Special Enrollment Examination is a rigorous and comprehensive test designed to assess a candidate's knowledge and understanding of the US tax code. By passing the EA exam, individuals demonstrate their expertise in tax preparation and consultation, allowing them to represent taxpayers before the IRS. If you’re considering taking the EA exam, it’s crucial to understand the exam basics, including what’s inside the exam, how hard it is, and the registration process. Although the exam can be challenging, with dedication, focus, and proper preparation, many candidates successfully earn their EA designation, opening the door to a rewarding career as a tax professional.

By JP Marino, EA

.png)

Comments